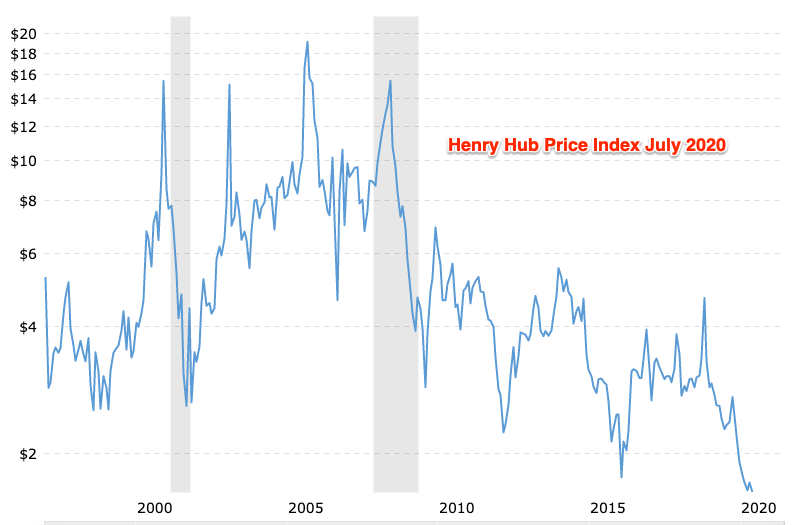

It’s been quite a year for energy prices, to put it mildly. The national natural gas spot market, as measured by the Henry Hub spot market, has not been this low in over 20 years.

Keep in mind the Henry Hub chart measures current gas prices. Honeydew typically helps companies secure rates for the next 1, 2, or 3 year terms. We are generally seeing lower prices on shorter terms, meaning suppliers are expecting increases in 2022 and 2023. Such price increases are likely to be driven by increased demand as we are expected to recover from the pandemic.

This being said, suppliers do not have crystal balls. After all, few foresaw the speed at which the pandemic brought down oil prices. Other natural disasters or political events could swing prices in either direction. Even things as simple as an unexpectedly cold winter can send rates skyrocketing. This is why we recommend in 99% of cases that our clients go with fixed rate options to eliminate uncertainty. Prices are so low right now, it makes sense to lock it in for a 3 year term.

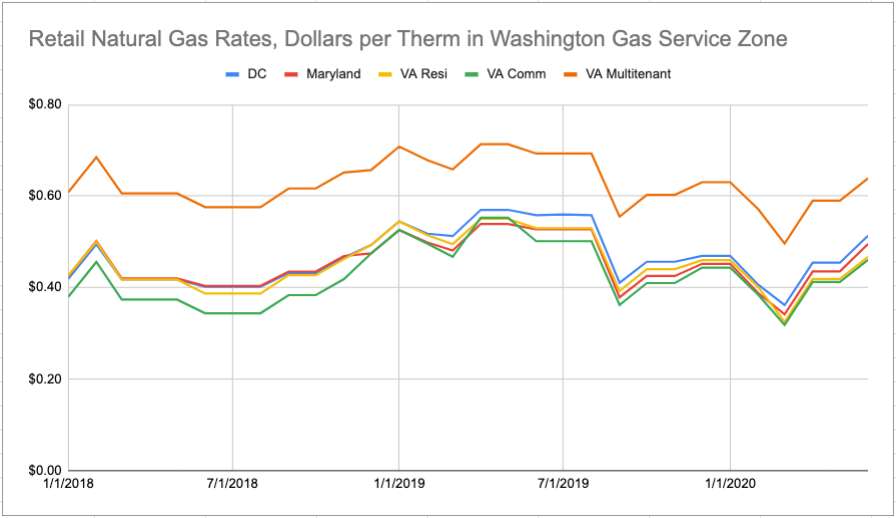

Here’s a look at natural gas rates across the District of Columbia, Maryland, and Virginia in the past two and half years to give you a sense of who the macroeconomic volatility affects the rates you pay and how it differs across jurisdictions. Despite national prices going down, Washington Gas has continued to increases its rates since the price collapse in March. Given this, its a great idea to lock in prices and prevent future increases.

If you’re interested in looking at fixed rate quotes, please contact a Honeydew Energy Advisor in the form below.