Energy commodity prices are notoriously difficult to predict. Unforeseen weather and political factors can dash the conclusions of the most thoughtfully orchestrated economic forecasts. We at Honeydew do not pretend to be experts at economic forecasting. Instead, we focus on encouraging our clients to view their energy procurement strategies in pragmatic terms.

As a business owner or manager, you likely have a myriad of priorities competing for your attention. You know you need electricity and natural gas to run your business, and you know you can afford it up to a certain rate. So what we can offer you is a perspective on how current costs compare to historical performance and what fixed rate options are available to you that allow budget certainty and eliminate pricing swings that can throw a wrench into your monthly budgets. Honeydew, working with its brokerage platform partner, can help your business secure supply contracts that will begin up to 2 years in the future and have terms lasting anywhere from 6 months to 5 years.

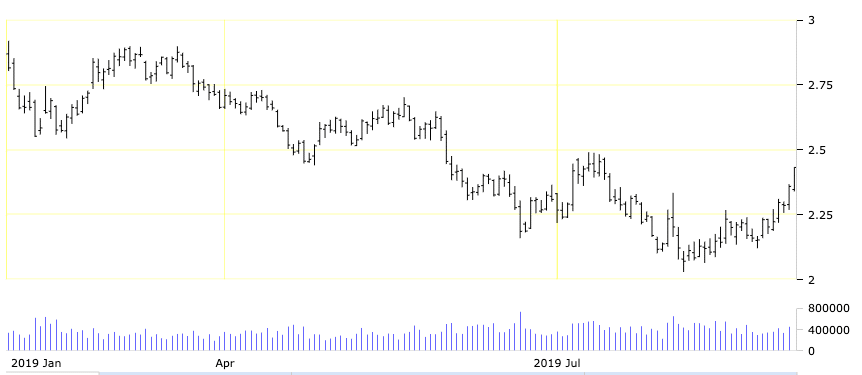

Below, you’ll see a chart of the NYMEX Natural Gas futures price curve. This chart represents the average price paid by end users to providers for natural gas to be consumed in the future. Not only is this index a major driver of your natural gas utility rate, but it also represents the most important factor in determining your electric rate. Pricing peaked at the beginning of the year (during the winter) and fell to multi year lows in August as frackers flooded the US market with a glut of supply. All said, prices declined by a full 25% during the first 8 months of the year.

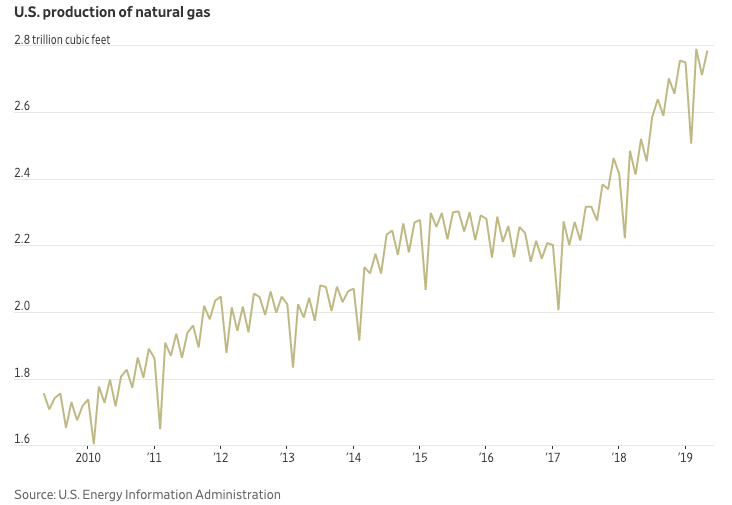

This price drop is explained quite well in the next image, showing the steep and steady increase in production over the past decade; especially steep in the past year.

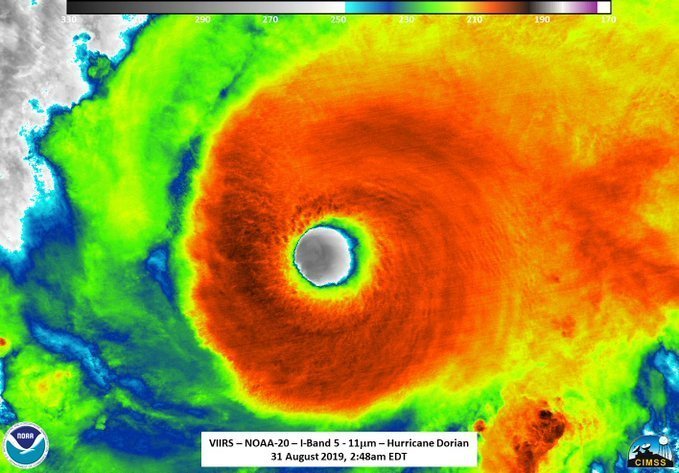

So now, why have prices jumped over 10% since August? Well, the title of this article gives that one away pretty clearly. Hurricane Dorian could lead to significant disruptions in the natural gas supply line. However, it’s nearly impossible to predict this risk accurately given the erratic nature of hurricane patterns. If Dorian spins out to sea early on, expect to see prices fall back toward levels seen in August. If it ends up being doozy, prices could easily go up another 10%+.

Looking longer term, domestic prices could increase significantly should we get a colder than expected winter or if international prices increase, causing more natural gas to be liquefied and exported.

We can’t tell you how much damage Hurricane Dorian will do, nor we can we tell you how cold it will be this winter. What’s more, we can’t tell you if the market movers are using pricing models that are accurately reflecting the myriad of risks in this market that could send futures prices soaring. What we can tell you: exactly how much your business can lock in prices for during the next few years AND how much lower those prices are relative to your current costs. Then, you don’t have to worry about all these unpredictable events! If you’re curious as to how your gas rate compares to the current market, shoot us an email per the form below and we’ll show you.